Welcome to dForce monthly update. We keep our community up to date about what to expect in the coming months.

TL;DR

-

In October, dForce announced collaborations with UPRETs, EntroFi, NAOS to power RWA-backed loans, allowing permissioned institutions and protocols to obtain USX liquidity from dForce, and generating juicy returns that are less correlated to the broader crypto market

-

dForce partnered with MCDEX to power DeFi perpetual trading by launching a USX pool on Binance Smart Chain, initially supporting perpetual contracts of BTC, ETH, as well as BNB. With this integration, users can either trade perpetual contracts and settle in USX (for up to 15x leverages) and receive MCB mining rewards, or providing liquidity to the USX pool to earn trading fee.

-

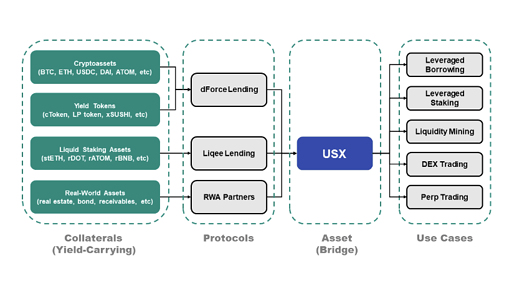

As a core asset across dForce ecosystem, USX is the engine that drives cross-protocol synergies and demonstrates great success in expanding dForce’s outreach to all spectrums, from lending to staking, trading, derivatives, RWA financing, etc.

-

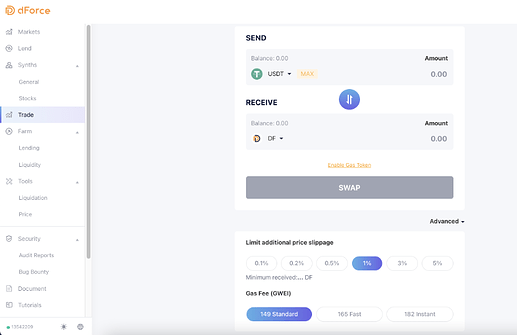

dForce Trade has been integrated into the all-in-one interface, where users can easily switch between lending and trading.

-

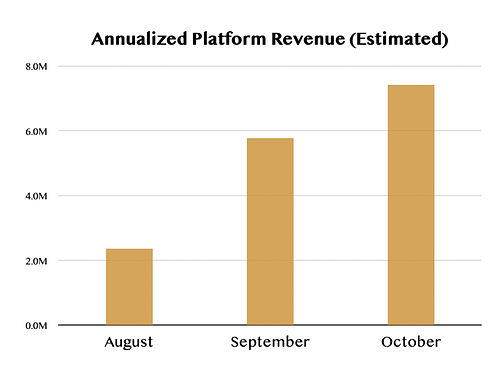

dForce recorded a projected Annualized Platform Revenue of $7.3m in October, representing a jump of 27.7% from September. Out of which, $1.3m (or 18.4%) has been classified as Annualized Protocol Revenue.

Overview

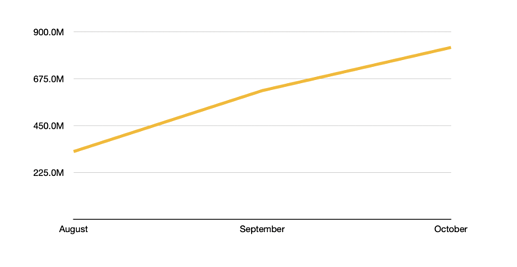

dForce recorded a Total Accumulated Borrowing of $825.9m by October, representing an increase of $172.8m in new loan origination, or 26.5% from previous month.

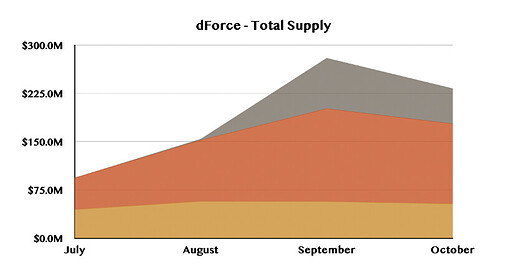

Total Supply achieved $233m (including Liqee) in October, down by $47m from previous month. Around 53.5% of the Total Supply are contributed by Binance Smart Chain, 23.0% by Ethereum and 23.5% by Arbitrum.

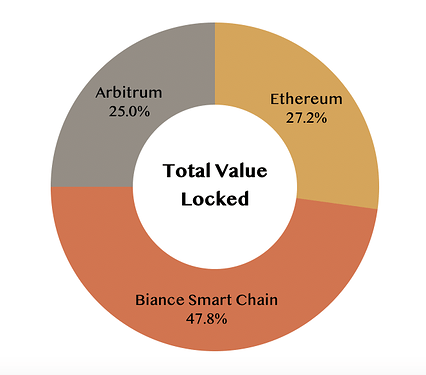

Total Value Locked across dForce network (Liqee included) on Ethereum, Arbitrum, and Binance Smart Chain amounted to $123.8m, down by $16m from previous month. Around 47.8% of the total liquidity are currently parked on Binance Smart Chain, 25.0% on Arbitrum, and 27.2% on Ethereum.

As an ecosystem project of dForce, Liqee contributed around $27.4m (or 11.8%) in Total Supply and $6.8m (or 10.1%) in Total Borrowing.

Revenue Breakdown

Glossary

- Platform Revenue: the total of interest paid by borrowers and fees generated from minting stablecoins (USX and EUX).

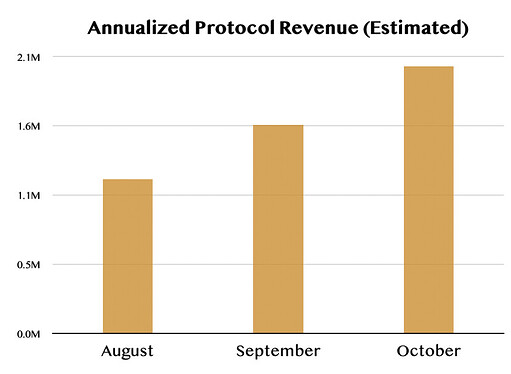

- Protocol Revenue: the total of reserves (interest spread between lending and borrowing) and fees generated from minting stablecoins (USX and EUX), which will be used to facilitate DF repurchase subject to future governance approval.

In October, dForce recorded a projected Annualized Platform Revenue of $7.42m, representing a MoM growth of 43.7% from September. In addition to interest paid by borrowers and stablecoin minting fees, trading fees generated from USX pool on MCDEX are mostly captured by dForce Treasury as Protocol Revenue.

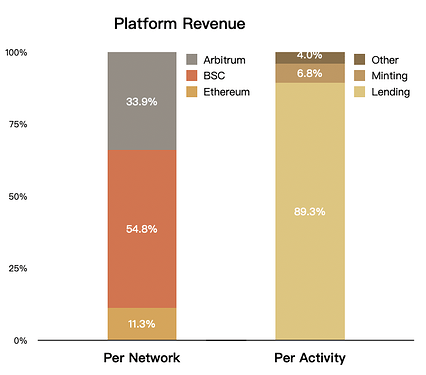

In respect of the Platform Revenue:

- Around 54.8% were contributed by Binance Smart Chain, 33.9% by Arbitrum, and 11.3% by Ethereum.

- Revenue generated from lending activities (interest paid by borrowers) accounted for 89.3% of the Platform Revenue, while 6.8% from stablecoins and 4.0% from MCDEX.

In respect of the Protocol Revenue:

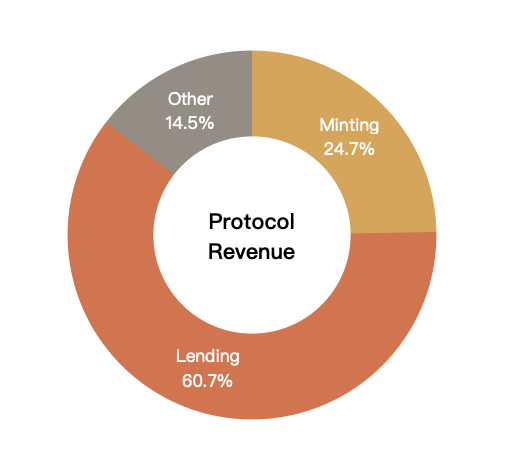

Approximately 24.7% of the Protocol Revenue were contributed by stablecoins (USX and EUX), 60.7% by lending, and 14.5% by trading fees generated on MCDEX.

In October, dForce recorded a projected Annualized Protocol Revenue of $2.0m, up by 23.0% from September.

Ethereum

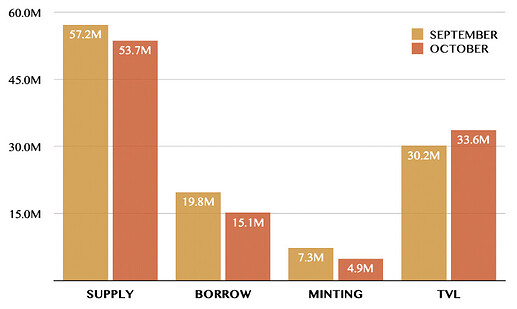

In October, dForce witnessed an increase of $3.5m in Total Value Locked on Ethereum, with a drop of $3.6m and $4.6m in Total Supply and Total Borrowing, respectively.

Top three assets supplied to dForce were ETH (29.34%), USDC (17.2%), and DAI (11.6%); top three borrowed were USDC (34.8%), USDT (33.5%), and DAI (27.2%).

Arbitrum

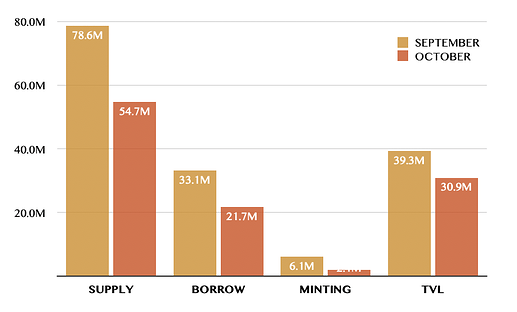

By end of October, dForce Lending achieved a Total Supply of $55m and a Total Borrowing of $22m, with $31m Total Value Locked on Arbitrum.

Top assets supplied were ETH (38.9%), USDC (25.9%), and USDT (17.8%). Top borrowed were USDC (50.2%), USDT (31.5%), and DAI 11.5%).

Binance Smart Chain

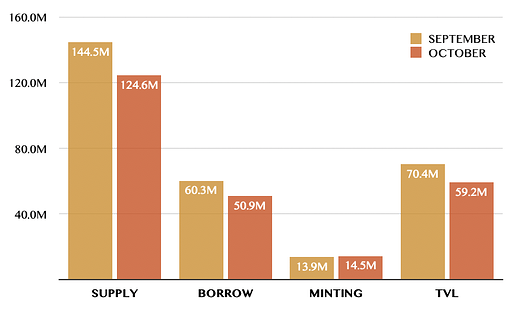

In October, Total Supply and Total Borrowing on Binance Smart Chain reached $125m and $51m, respectively, with $14m in Total Minting (mainly stablecoins) and $59m in Total Value Locked.

Top assets supplied were ATOM (32.2%), BUSD (12.6%), and BTCB (11.39%). Top borrowed were BUSD (25.1%), USDC (16.0%), and USDT 15.3%).

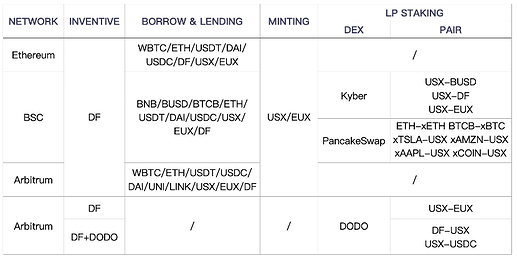

Liquidity Mining

dForce offers long-term incentives for lending, borrowing, as well as providing liquidity for dForce-backed assets on Ethereum, Arbitrum, and Binance Smart Chain. We have also kicked off joint liquidity mining with DODO on Arbitrum. Please visit dForce Forum for the latest gauge (update on a weekly basis).

Extensive Reading

Product Development

Yield Token Pool

Independent lending pool catering to yield tokens (i.e., LP tokens, iTokens, etc), allowing users to make full use of interest-bearing tokens sitting idle in your wallet for boosted capital efficiency. Expected launch in Q4.

DF Staking

The DF staking system allows users to stake DF token for vDF token, which can be used to propose and vote on critical protocol decisions, capture value directly from dForce protocols, and receive inflationary rewards from staking, etc. Expected launch in Q4.

Cross-Chain Bridge

A toolkit facilitating immediate swap for dForce-backed assets across Ethereum, Arbitrum, and BSC. Expected launch in Q4.

Business Development

dForce Partners with MCDEX to Power DeFi Perpetual Trading

dForce partnered with MCDEX to power DeFi perpetual trading by launching a USX pool on Binance Smart Chain, initially supporting perpetual contracts of BTC, ETH, as well as BNB. With this integration, users can either trade perpetual contracts and settle in USX (for up to 15x leverages) and receive MCB mining rewards or providing liquidity to the USX pool to earn trading fee.

Extensive Reading:

- dForce Partners with MCDEX to Power DeFi Perpetual Trading

- How USX Empower Perpetual Trading

- How to use USX to trade perps on MCDEX

dForce and UPRETs Partner to Onboard Real-World Assets backed Loans

dForce and UPRETS announced their collaboration to power RWA financing. UPRETS is a platform focused on simplifying investment in real estate by advising on and digitalizing assets and securities. It is also helping MakerDAO originate its first real-world solar farm financing deal (click here to learn more). Through this collaboration, dForce will provide trustless and highly efficient capital infrastructure (DeFi) entwined with UPRETS bringing regulated tokenized RWAs into DeFi.

Extensive Reading:

dForce Announced Inter-Protocol Collaboration with EntroFi to Power Real-World Financing and Permissioned Institution Onboarding

Following Liqee, dForce announced collaboration with EntroFi of USX’s credit line extension, leading USX adoption by allowing permissioned institutions and protocols to obtain USX liquidity from dForce. This protocol-to-protocol integration will allow dForce to use EntroFi as a portal to connect to borrowers in various forms, and facilitate easy execution for RWA deals. Borrowers can use EntroFi’s portal to interact with dForce’s USX protocol.

Extensive Reading: